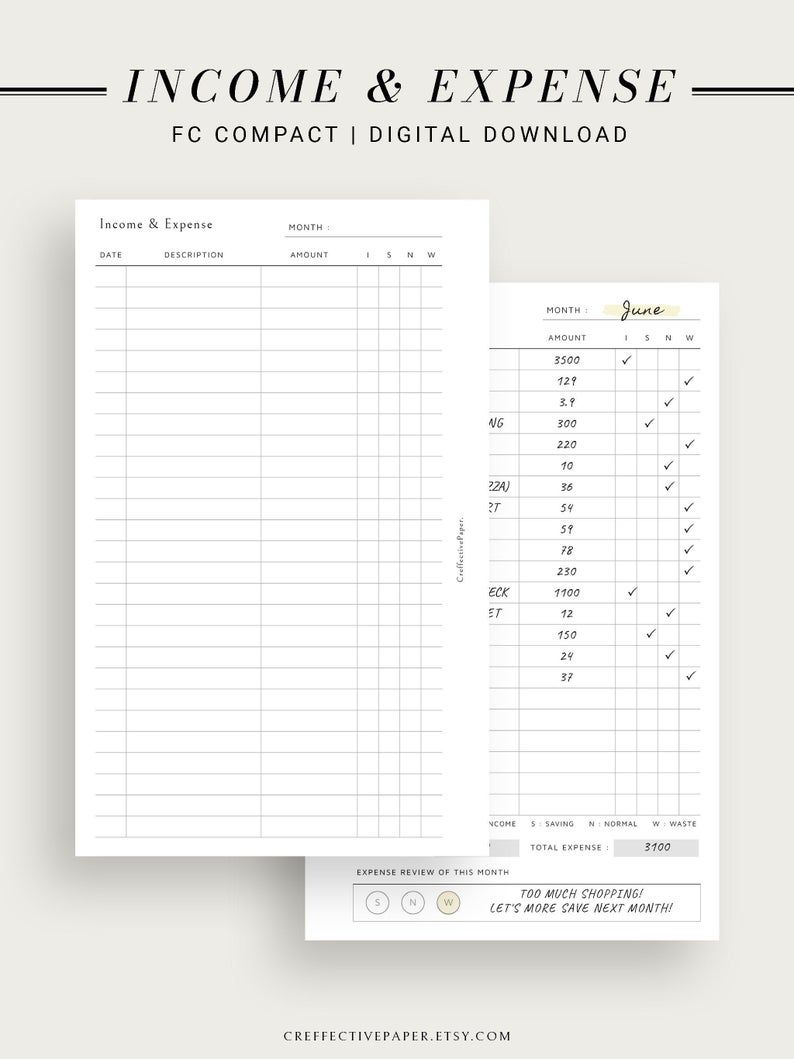

When I taught high school economics, I generally assigned my students to keep track of their spending for a week using expense trackers like these. You might also like: How to Save $5000 in 6 Months Or Faster (With Progress Chart!) So easy, a teenager can do it Then, at the end of the month, you’ll know EXACTLY where all your money went! Once you know that, you’ll be able to set a budget, save for big expenses, pay down debt, or meet whatever financial goals you have. In just a few seconds a day, you can track all your purchases, bills, and expenses.

This can highlight areas of your lifestyle that might benefit from some trimming. Using an expense tracker can help you know how much you’re spending.

I know I tend to talk more about frugal living here, but you do need to spend money eventually. According to Mint, 65% of Americans don’t know how much they spent last month. If you’re ready to stop being one of them, I’ve created a free printable expense tracker to help you out.

0 kommentar(er)

0 kommentar(er)